Invest in real estate while working! Discover how steady income boosts your investment power and builds long-term wealth.

9 Compelling Reasons to Invest in Real Estate While Employed

9 REASONS WHY YOU SHOULD INVEST IN REAL ESTATE

-real estate talk-

-do it while you are still working-

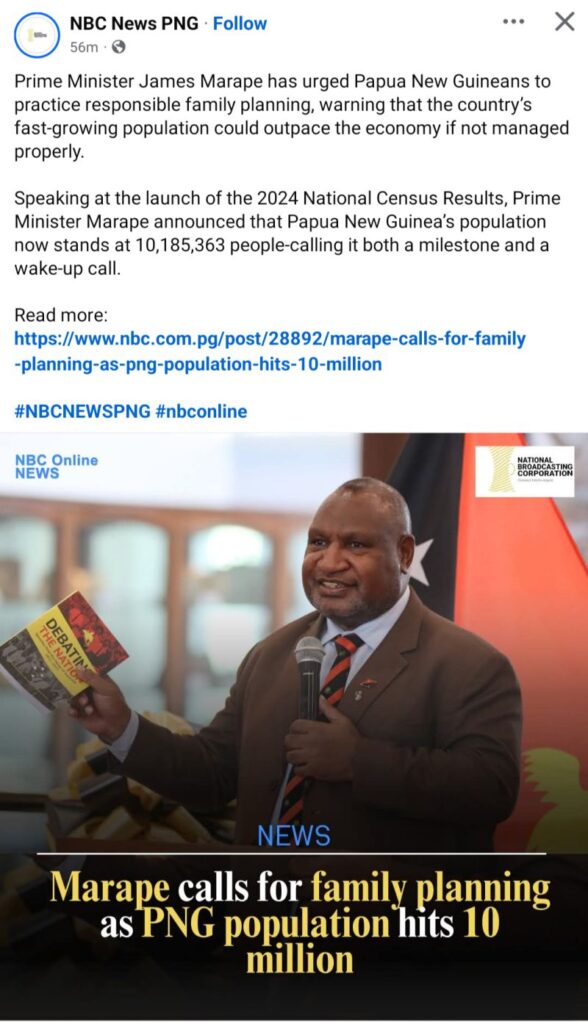

Real estate investment is often seen as something reserved for businesspeople or full-time investors. However, even as an employee, investing in real estate can be a smart move.

Here are 10 reasons why you should consider it:

💰 1. Steady Income from Employment

Being employed means you have a steady source of income, which can help you secure loans or finance your real estate investments. Lenders view a stable salary as a positive sign, making it easier to qualify for a mortgage.

💰 2. Leveraging Your Salary for a Loan

As an employee, banks are more likely to offer you favorable mortgage terms. You can leverage your salary to get a loan with a lower interest rate and use that to buy property without having to pay the full price upfront.

💰 3. Building Wealth Gradually

Real estate investment is a proven way to build wealth over time. While working your job, your property appreciates in value, and you can also generate rental income. Both contribute to long-term financial growth.

💰 4. Creating a Passive Income Stream

Renting out property can give you an additional stream of income while you continue working. This passive income can supplement your salary and help you achieve financial freedom sooner.

💰 5. Hedge Against Inflation

Real estate is one of the best investments to protect against inflation. As the cost of living rises, so does the value of your property and the rent you can charge, while your fixed-rate mortgage remains the same.

💰 6. Retirement Security

Investing in real estate while still employed helps you plan for retirement. By the time you retire, the property may be fully paid off, providing you with a valuable asset that can either be sold or generate retirement income.

💰 7. Diversifying Your Investment Portfolio

Most employees invest in stocks, bonds, or mutual funds through their retirement plans. Real estate offers a way to diversify your portfolio, reducing your overall investment risk and giving you another source of growth.

💰 8. Opportunity for Property Appreciation

Over time, real estate tends to increase in value. By investing early, you stand to benefit from property appreciation, which can yield substantial returns, especially if you buy in a growing area.

💰 9. More Control Over Your Investment

Unlike stocks or other investments, you have direct control over your real estate investment. You can choose the property, make improvements, decide on rental terms, and ultimately determine its value through your decisions and actions.

By investing in real estate while being an employee, you can gradually build wealth, create passive income, and set yourself up for long-term financial security. It’s a powerful way to make your money work for you while continuing your career.

PLEASE SHARE IT 🙏 🙂.

Similar Purchasing A Home Posts from Mr. Ismael Long:

Align Your Finances: The Key To Homeownership Mastering Homeownership: Your 2-Year Plan To Save For A House Deposit Building Your Dream Home: A Guide To Navigating Costs And Mortgages Empower Your Real Estate Dreams; Create Your Path To Homeownership – Invest In Real Estate Unlocking Homeownership; The Advantages of Father and Son Joint Mortgages Home Ownership Made Easy In 3 Essential Steps; A Guide For Purchasing A House How To Own Your First Home In Papua New Guinea With Zero Tax Tips For First Home Buyers in Papua New Guinea Unlocking Wealth Through Financial Literacy – Invest In Real Estate Understanding CPI And Inflation: What It Means For Your Wallet In Papua New Guinea Regulating Housing Prices And Rentals In Papua New Guinea: Addressing Affordability And Quality For The Working Class The Importance Of Experience: Why You Should not Rely On Non-Property Owners For Real Estate AdviceRead more news and stories here. Watch online news and documentaries about Papua New Guinea here.