The Taxation Tumult in Papua New Guinea: An In-Depth Exploration

In the midst of the current economic landscape in Papua New Guinea (PNG), a nuanced and somewhat tumultuous picture emerges. High inflation rates coupled with stagnant economic growth have become salient features characterizing the economic conditions in the nation.

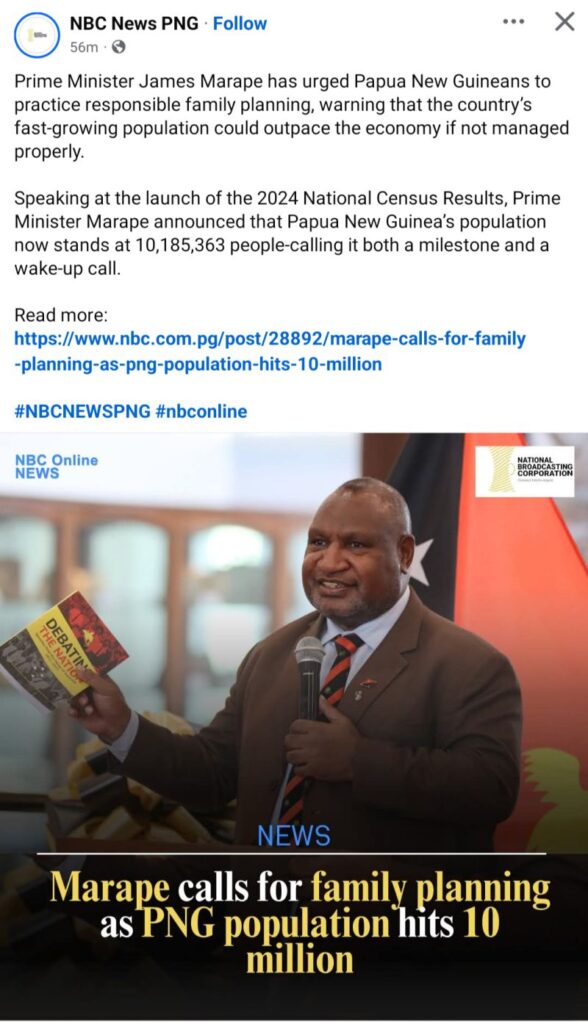

Within this context, it is imperative to examine the profiles of middle-income earners who find themselves at the crossroads of economic uncertainty. The recent decision by the Marape Government to increase income tax introduces a significant ripple effect, directly impacting the financial stability of this demographic. As the backbone of the nation's workforce, understanding the implications of this tax hike on their livelihoods becomes pivotal.

The decision to increase income tax comes at a challenging juncture for PNG. Stagnant economic growth and high inflation rates create a precarious environment where fiscal policies require meticulous calibration. The Marape Government's rationale for this decision warrants scrutiny, particularly in light of the broader economic challenges the nation faces.

Unsurprisingly, the public reaction to the income tax increase has been diverse, reflecting the varied economic circumstances of the population. While some acknowledge the necessity of such measures in addressing economic woes, others voice concerns about the potential exacerbation of financial hardships for middle-income families. This diversity in public sentiment underlines the complexity of navigating economic policies in a nation marked by socioeconomic diversity.

The decision to increase income tax does not unfold in isolation; it carries with it the potential for significant political repercussions. As public sentiments crystallize, political figures find themselves in the precarious position of balancing economic imperatives with the need to maintain public trust. The political landscape in PNG may witness shifts and reactions based on how effectively leaders manage the fallout from this decision.

Debt Dilemmas and the Controversial Borrowing Spree

Papua New Guinea finds itself at a critical juncture as it grapples with mounting debt, sparking concerns and debates surrounding the nation's fiscal health. The Debt to GDP ratio, a crucial economic indicator, currently stands at 51.60%, signifying a significant financial obligation relative to the country's economic output. This statistic serves as a point of analysis, necessitating an exploration into the implications and intricacies of Papua New Guinea's financial landscape.

PNG's Debt to GDP Ratio at 51.60%: An Explanation and Its Implications

The Debt to GDP ratio is a key metric reflecting the proportion of a country's debt concerning its economic productivity. At 51.60%, Papua New Guinea's ratio raises eyebrows and prompts a closer examination of the factors contributing to this figure. A comprehensive exploration is essential to understand the dynamics of debt accumulation, shedding light on whether it is driven by strategic investments, economic challenges, or a combination of both. The implications of such a ratio are multifaceted, encompassing potential impacts on credit ratings, investor confidence, and the government's ability to meet its financial obligations.

The Marape Government's Continued Borrowing and How It Affects PNG's Financial Stability

A spotlight on the Marape Government reveals a pattern of continued borrowing, further intensifying discussions about the nation's financial stability. The reasons behind this borrowing spree, whether fueled by infrastructure development, economic revitalization, or other strategic imperatives, warrant scrutiny. Assessing the government's borrowing practices against the backdrop of economic indicators and global financial trends becomes imperative. This evaluation is crucial in determining whether these borrowing endeavors align with sustainable economic practices or pose inherent risks to Papua New Guinea's financial resilience.

Comparison of PNG's Debt Policies with Global Best Practices

In the realm of international finance, comparing Papua New Guinea's debt policies with global best practices becomes a vital exercise. Benchmarking against nations that have effectively managed debt challenges provides insights into potential strategies for improvement. This comparative analysis spans debt management frameworks, transparency in financial reporting, and mechanisms for debt repayment. Understanding where Papua New Guinea stands in relation to global benchmarks serves as a compass for policymakers, facilitating informed decisions to navigate the nation's economic course.

The Cost of Politics: Assessing the Fiscal Impact of Government Spending

In scrutinizing the fiscal landscape, it is imperative to delve into the international travels of Prime Minister James Marape (PMJM) and the consequential expenses borne by taxpayers. An objective analysis of these journeys becomes essential to gauge their economic implications, shedding light on the balance between diplomatic responsibilities and prudent financial governance.

Prime Minister Marape's International Travels: A Fiscal Examination

Prime Minister James Marape, as a key representative of Papua New Guinea on the global stage, engages in international travels that incur substantial expenses. While diplomatic endeavors are crucial, a comprehensive analysis is necessary to ascertain the fiscal prudence of these ventures. Transparent reporting and scrutiny of the costs associated with PMJM's overseas visits provide the public with a clearer understanding of the financial implications.

Impact on Public Services and Infrastructure: Navigating Economic Constraints

Government spending has a direct correlation with the state of public services and infrastructure, particularly against the backdrop of economic constraints. As funds are allocated for international travel and related expenses, the impact on essential services at the domestic level cannot be understated. This analysis aims to delineate the trade-offs between investing in diplomatic engagements and ensuring the sustained development of critical public services and infrastructure projects.

Setting Priorities: Navigating Essential Spending versus Political Expenditure

In the delicate balance between essential spending and political expenditure, the government faces the challenge of setting priorities that align with the best interests of the nation. With economic constraints posing limitations, a judicious allocation of resources becomes paramount. This examination seeks to illuminate the decision-making processes behind budgetary allocations, emphasizing the need for prudent financial management that prioritizes the well-being and development of the populace.

Rethinking Tax Strategies: Alternatives to Raising Income Tax

In the realm of fiscal policy, the conversation around taxation strategies is gaining prominence, especially in the context of economic challenges. One alternative gaining traction is a reevaluation of the traditional approach of raising income tax rates. Instead, experts are exploring the viability of leveraging excise duty as a more rational fiscal tool. This shift is rooted in the understanding that income tax hikes can have far-reaching implications on battling food inflation and mitigating living costs for middle-income earners.

Exploring Excise Duty as a Rational Fiscal Tool

The shift towards exploring excise duty as a primary fiscal lever is grounded in the belief that it can offer a more targeted and nuanced approach to revenue generation. Unlike income tax hikes that affect broad segments of the population, excise duties can be strategically applied to specific goods and services, allowing for a more measured impact on consumer spending.

Addressing Food Inflation and Living Costs

The effects of increased income taxation on battling food inflation and managing living costs, particularly for middle-income earners, are significant concerns in the current economic landscape. Income tax hikes often place an additional burden on individuals already grappling with the rising prices of essential goods. The exploration of excise duty as an alternative seeks to strike a balance, generating revenue without disproportionately affecting the cost of living.

The Necessity for Progressive Taxation and Wagner's Law

A crucial aspect of this conversation centers on the necessity for progressive taxation, ensuring that the burden is distributed equitably across income brackets. In this context, Wagner's Law, which posits that as a nation's income grows, the proportion of income spent on public goods and services increases, gains relevance. Implementing a fair tax regime requires a nuanced understanding of income distribution and a commitment to progressive taxation to ensure that the burden falls proportionally to one's ability to pay.

Expert Voices: Economists Weigh In on Taxation Strategies

Amid these discussions, economists play a pivotal role in shaping the narrative around taxation strategies, especially during financial crises. Expert voices emphasize the need for careful consideration and strategic planning to navigate economic challenges. By exploring alternatives to income tax hikes, considering the implications on food inflation and living costs, and embracing progressive taxation principles, nations can chart a course toward a more resilient and fair fiscal future.

In summary, the intricate taxation landscape in Papua New Guinea, coupled with the nation's Debt to GDP ratio, the fiscal implications of international travels by Prime Minister James Marape, and the ongoing discourse on rethinking tax strategies, collectively underscore the complexity of economic challenges facing the country. These multifaceted issues demand meticulous examination and transparent discourse to guide sustainable fiscal policies, secure economic well-being, and foster growth and prosperity. As Papua New Guinea navigates this economic terrain, the decisions made today, whether related to taxation, debt management, or resource allocation, will inevitably shape the trajectory of the nation's future.

God bless Papua New Guinea!

TOP NEWS

The Significance Of The Connect PNG Program Under Marape-Rosso Government Papua New Guinea Nationwide Call for Prime Minister James Marape to Sack Minister Justin Tkatchenko Ok Tedi Mining Fired a Woman Employee for Refusing Sex! After Seven Tough and Long Painful Years, Faith Got Her Bachelor in Property Valuation and Management – True Story to Inspire Young PNG Girls and Women Peter O’Neill’s Statement on PNG-US Security Agreement – To the Nation of Papua New Guinea Dr Bal Kama: 4 KEY ISSUES WITH PNG-US SECURITY AGREEMENT AS LEAKED: DELAY SIGNING UNTIL FIXED PNG Postal Codes: Post PNG Limited's revision improves the efficiency and reliability of mail and parcel delivery services in PNG.